Out Of This World Info About How To Reduce Credit Card Fees

Choose the right pricing models;

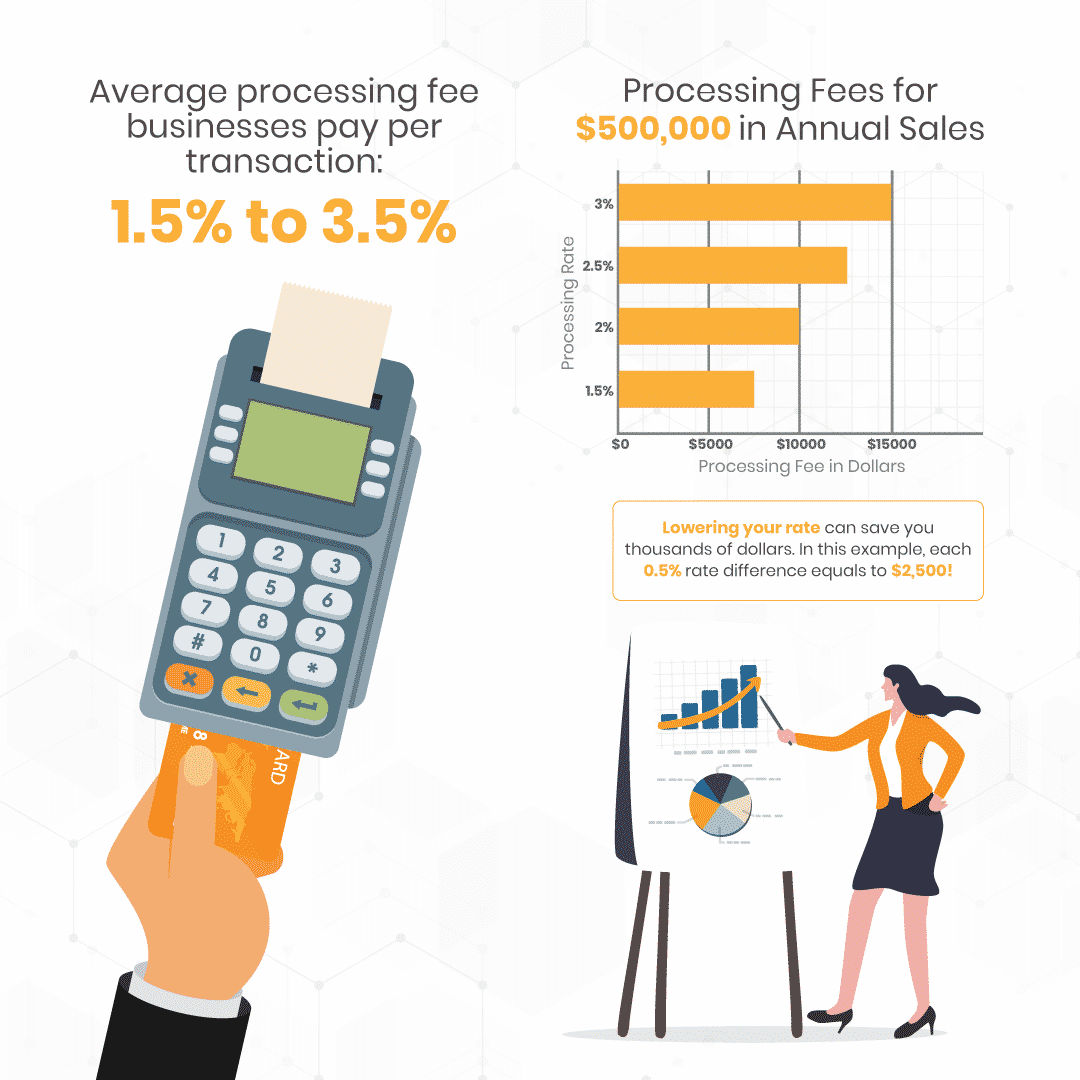

How to reduce credit card fees. Shop around and negotiate for the best rates. Luckily, this is something that you can easily change to help reduce your interchange fees. One of the easiest ways to lower your credit card payment fees is going right to the source — the.

By capturing more customer data, you can reduce chargebacks and increase the cvrp, which should significantly reduce your overall processing costs. All it takes is accepting payments using the safest method available to you. According to a recent study from financial search engine billshrink.com, small businesses will be hit with an.

The first and most obvious step should be to search for a merchant. It is actually possible and encouraged. 10 ways to lower credit card processing fees 1.

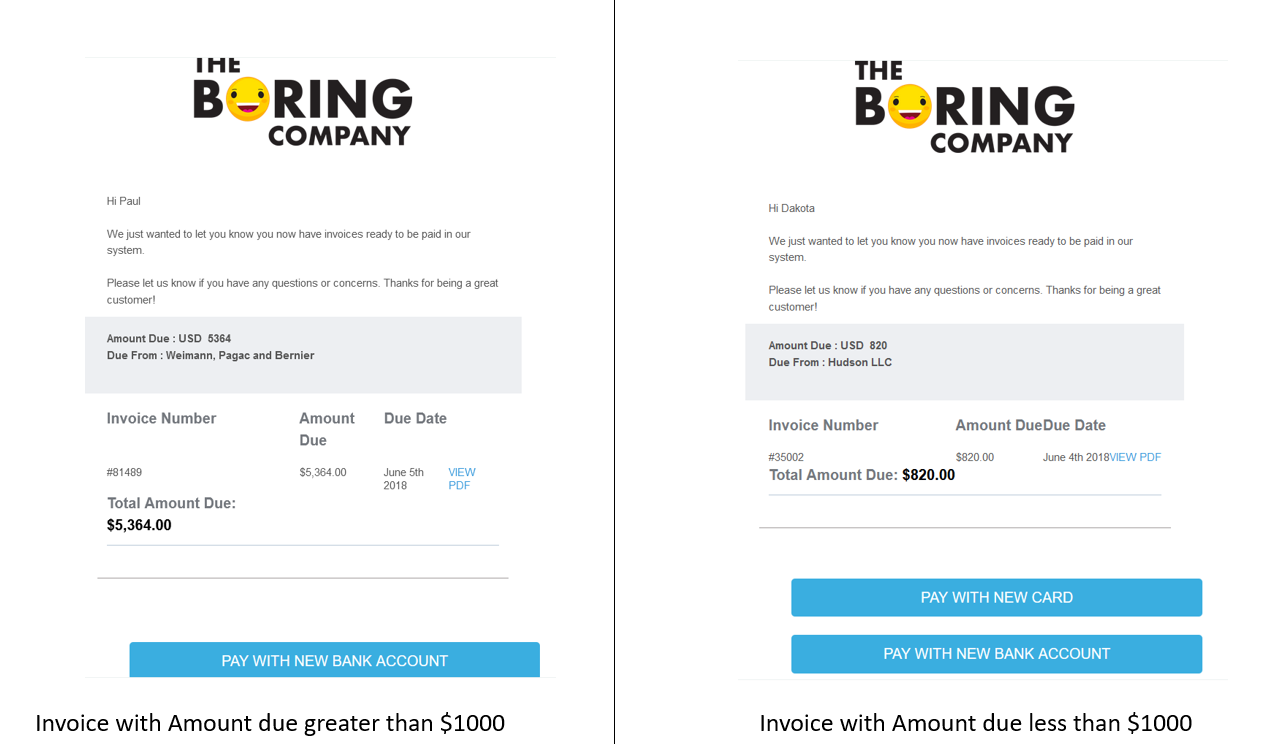

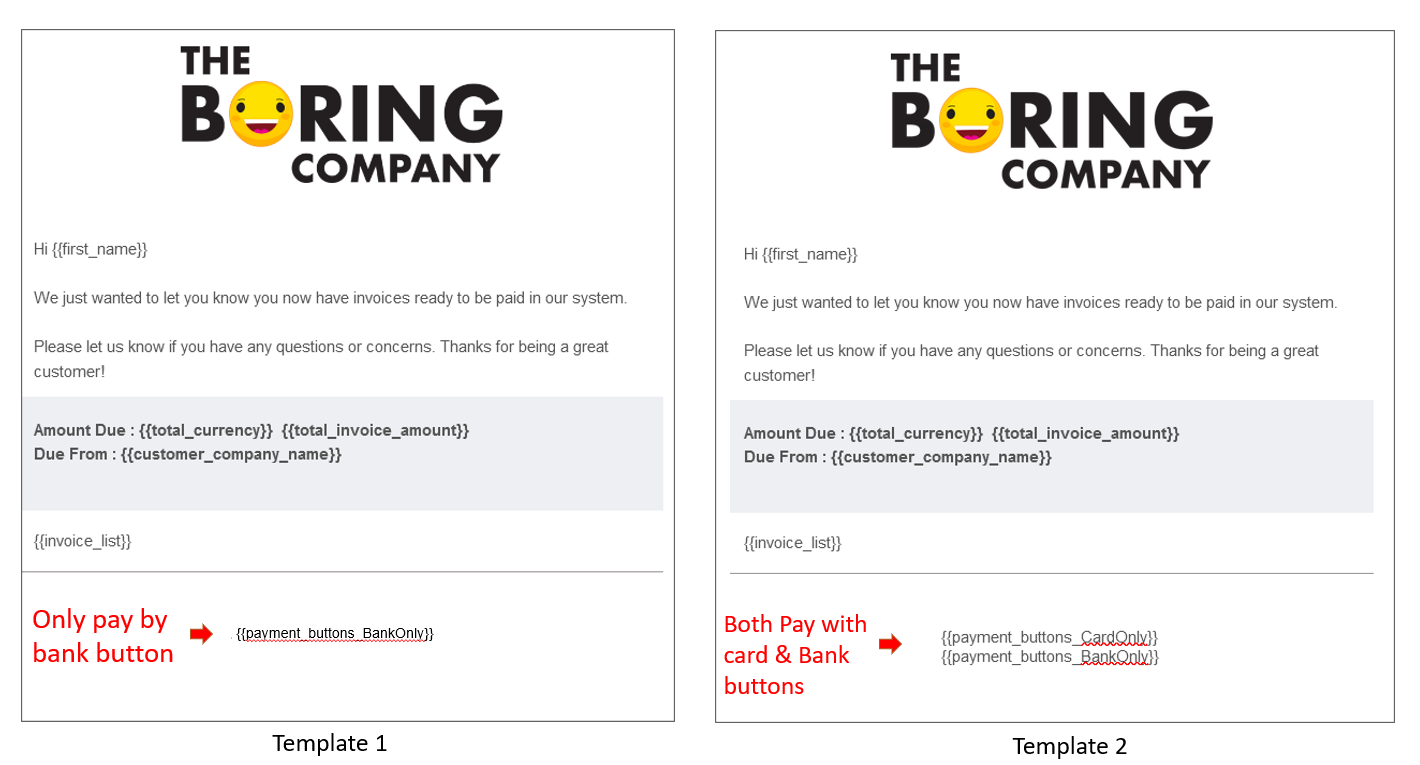

If you accept business credit or purchasing cards, consider passing additional information in the transaction. Based on the example above, any sale over $20 or above is going to be less expensive on pin debit: Allow customers to pay via credit card only if the invoice value is less than $100.

The best way to lower the cost of your credit cards is to pay your balances on time and in full every month. Learn where these fees come from and how you can reduce your cost in our comprehensive guide. 2 days agoonce you’ve applied, the steps are as follows:

($20 x.05%) + $.42 = $.43 total processing fee. Negotiate the markup fee with credit card processors; This will lower your interchange fee.