Who Else Wants Tips About How To Detect Fraudulent Checks

Up to 20% cash back use cases.

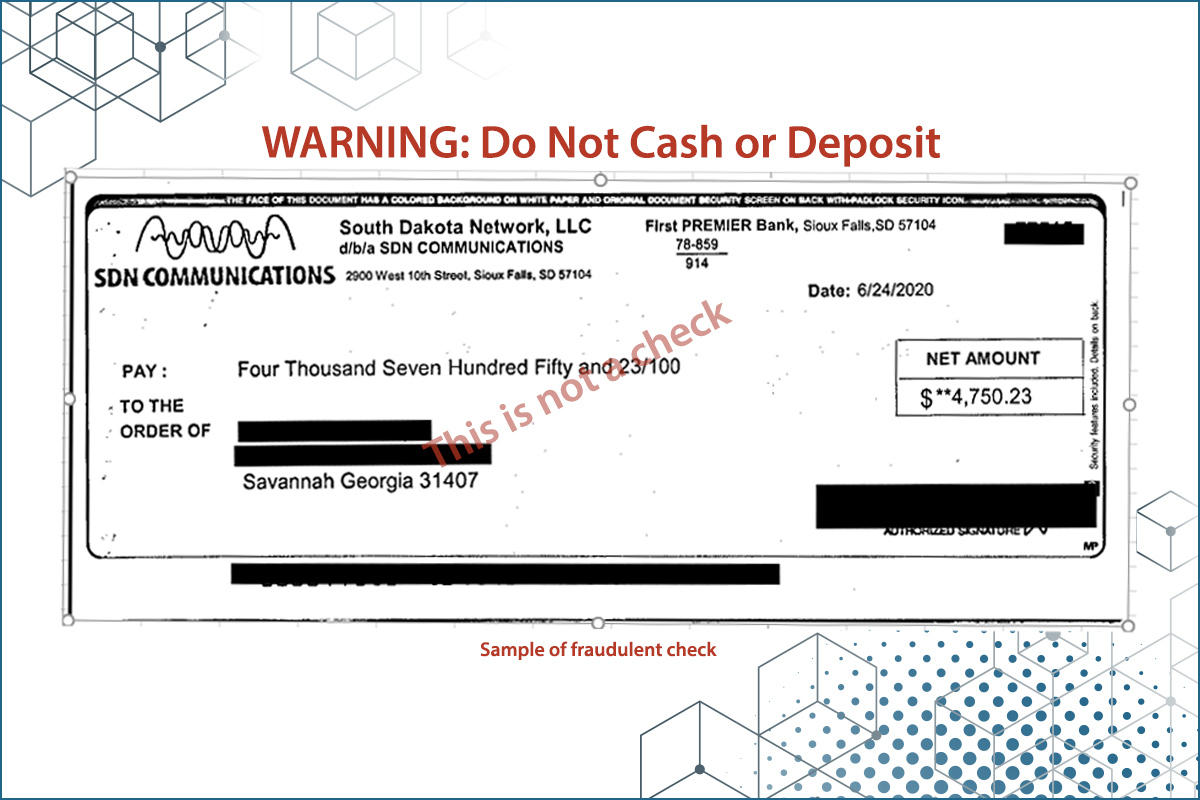

How to detect fraudulent checks. Card verification value (cvv) — the three numbers on the back of a card take merchants a step closer to identifying online fraud transitions. Fake checks and your bank. If the postmark is not the same as the city and.

Scammers take advantage of anything that might make you vulnerable in the public health crisis caused by the coronavirus or. Just because you can withdraw the cash quickly doesn’t mean the check is real. Fake checks take weeks to discover.

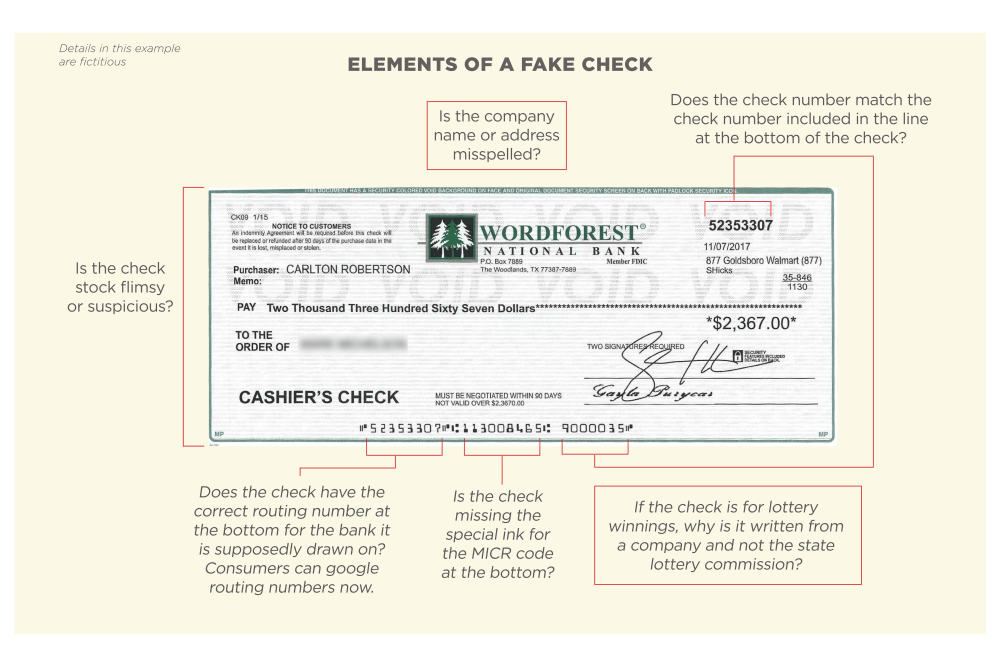

Fake checks can take weeks to discover. Here are some indications that a check may be fraudulent: Look to see where the check was mailed from.

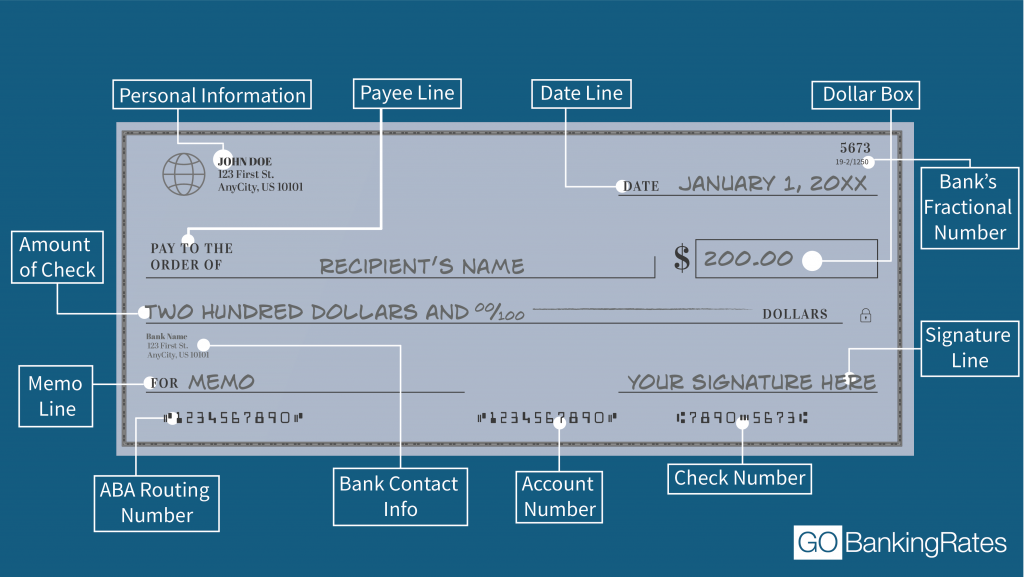

Monitor your accounts check your account activity frequently for anything unusual. 6 ways to spot a fake check 1. • the customer’s or bank’s address is missing.

View your online accounts to detect fraud earlier and contact your financial institution immediately if you. The check number is low, such as 0 to 400 on personal checks or 1001 to 1500 on business checks. Other signs that a check is a fake include:

Bank tellers should know how to visually assess a check for signs of fraud, but you should also invest in machine learning software that can identify fraud flags based on the look of the. If the cvv entered at the. • the signature has gaps.

/cdn.vox-cdn.com/uploads/chorus_asset/file/18995632/Cashier3.jpg)